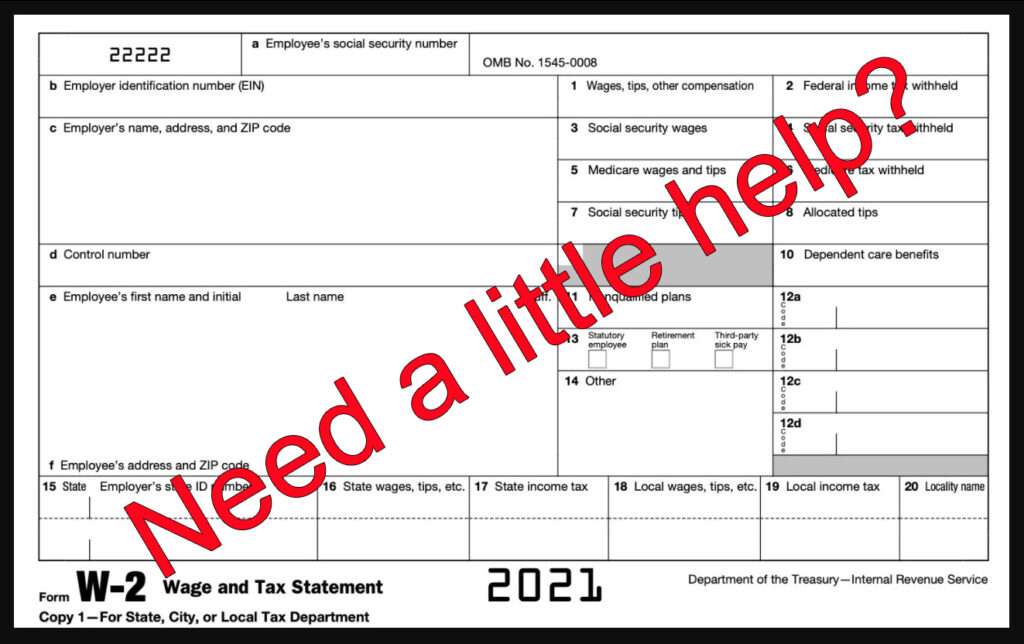

Each January, many churches prepare their own W-2 forms for employees.

For churches that file their own W-2s without the assistance of a payroll processing company, the Conference Treasurer’s Office recommends using the Social Security Administration’s website – Business Services Online – to create, file and print the W-2s.

No software is required. You can complete up to 50 W-2 forms and print copies suitable for distribution to your employees. If you create and file the W-2s this way, you will not need to mail paper copies to the Social Security Administration.

To get started, you must register at Business Services Online:

- Click on the blue “Register” button at the upper right and complete the required information.

- You will receive a user ID immediately, after which you will choose your own password.

- Once you have registered as a user, you return to the BSO website and log in with your new user ID and password.

From there, select “Report Wages to Social Security,” follow the instructions, and select “Create/Resume Forms W-2/W-3 Online.”

If you’re still not sure about registering at Business Services Online, here is a tutorial to walk you through that process:

You will find more helpful guidance on this Social Security Administration page. Scroll down and click on “Videos, Tutorials & Handbooks.”

If you are not comfortable using this website to complete and file your W-2s, you also might be frustrated because it is difficult to purchase small quantities of W-2s from office supply stores.

The Conference Treasurer’s Office has a small inventory of 2021:

- W-2 forms

- W-3 forms

- 1099 NEC forms

- 1096 forms

Call the United Methodist Conference Center at 803-786-9486 and request up to four forms.